loose leaf books of accounts deadline

Loose-Leaf Books of Accounts. These loose-leaf forms must be bound as accounting records and submitted to the BIR within 15 days after the end of the taxable year.

Masyadong Bang Marami Ang Transactions Mo Monthly At Halos Sa Maubos Na Ang Oras Mo Sa Pag Bobookkeeping Manually Every Month Apply Na For Loose Leaf Bookkeeping Check Here The Steps On How

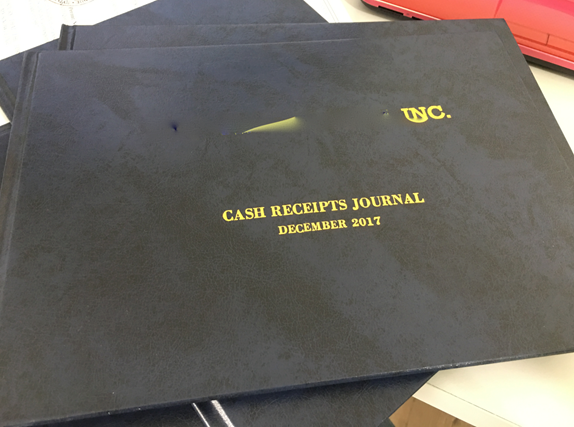

Identifying the type of books that will be used.

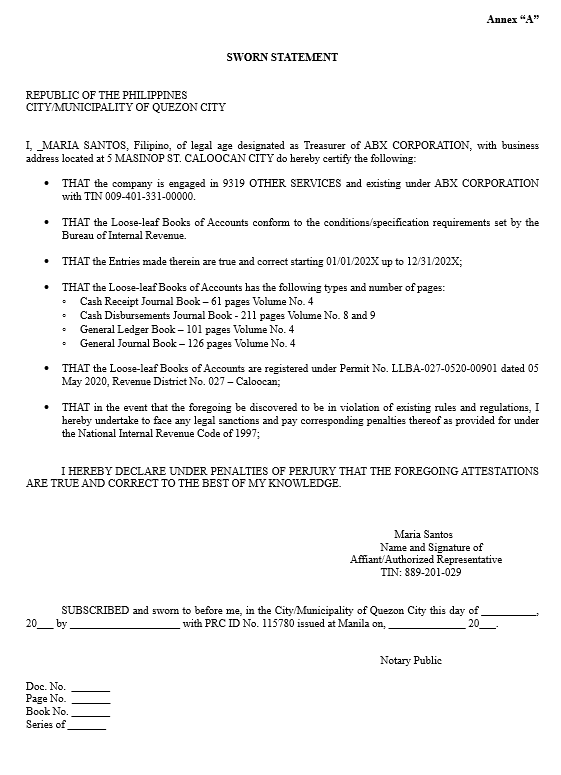

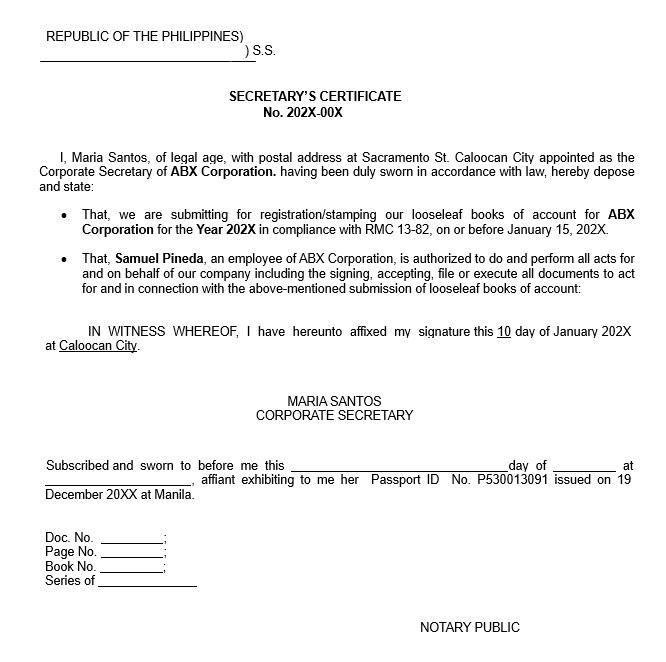

. An affidavit must also be submitted confirming the type of books the number of pages. 68-2017 clarified that although the use of loose-leaf books is. An Ultimate Guide to Loose Leaf Books of Accounts.

In line with the ease of doing business. Can I request an extension for the deadline for submission of Loose-Leaf Books of Accounts. These books must be submitted on or before 15 January 2021.

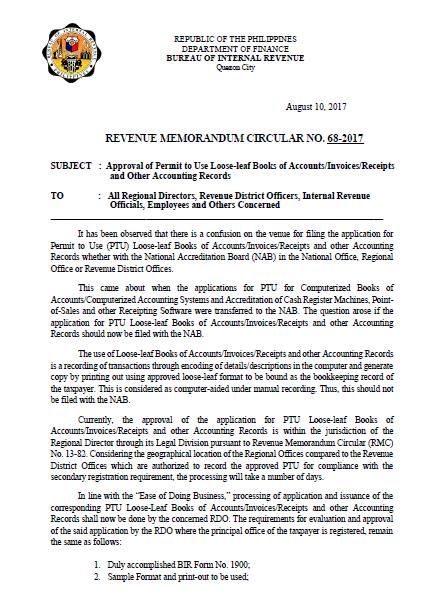

Some may not be aware that there is also another type referred to as loose-leaf records. Revenue Memorandum Circular RMC No. The BIR may request additional requirements including.

This is one of the Bureau of Internal Revenues BIR prescribed way of recording books of accounts. B Permanently bound Loose Leaf Books of Accounts. Submission of Bounded Loose-leaf Books of Accounts.

Companies that use the Computerized Accounting System CAS must submit their books and any other. If you miss the deadline the penalty ranges between Php 1000 25000. Updated guidelines on PTU loose-leaf filing.

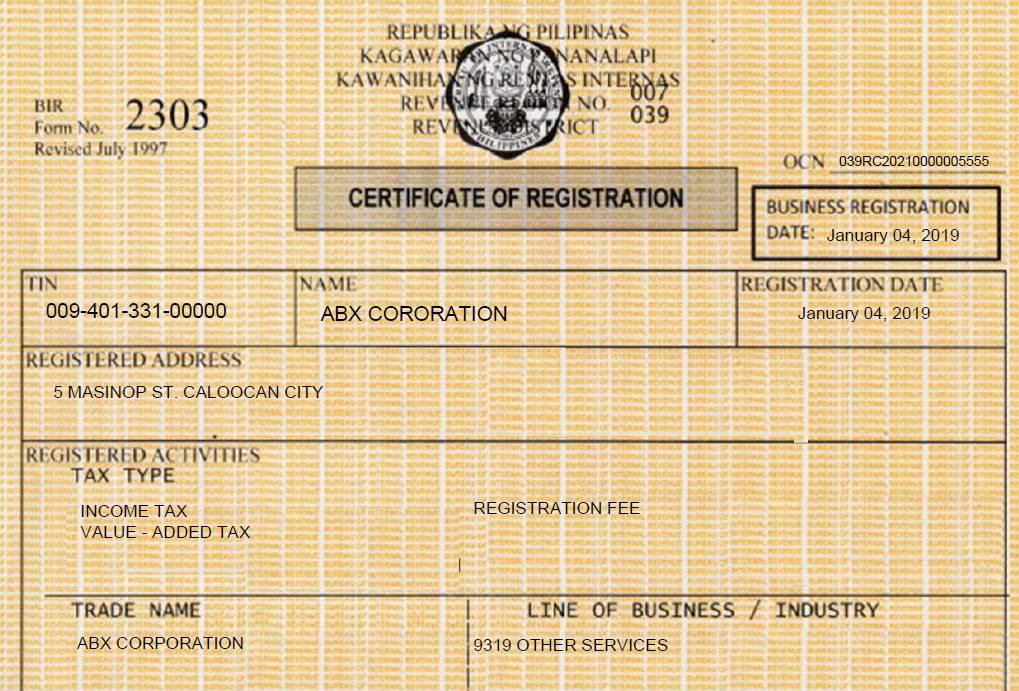

Proof of payment of BIR Form No. Most taxpayers are familiar with two types of books or accounting records those that are prepared manually and those that are generated by a computerized system. 0605 current annual registration fee.

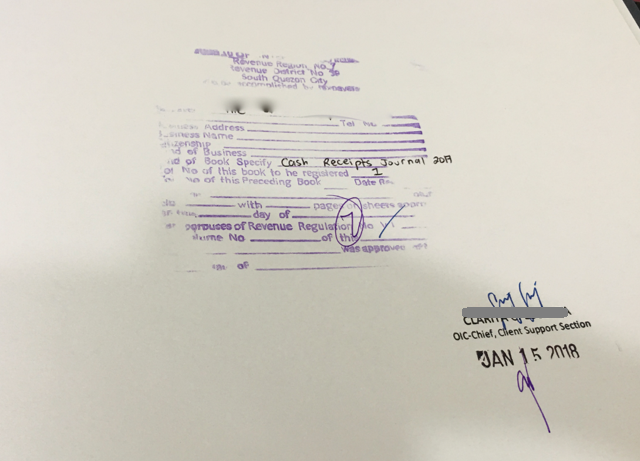

The registration of a new set of manual books of accounts shall only be at the time when the pages of the previously registered books have all been already exhausted provided that. A Permt to Use Loose Leaf Books of Accounts. In accordance with Revenue Memorandum Order RMO No.

Bureau of Internal Revenue. One of the commonly used Loose Leaf Bookkeeping application is PUBLISHED DATE. These books must be filed on or before 15 January of the following year.

You just need to submit a letter to your RDO that requests an extension of the submission of loose-leaf books. Computerized Books of Accounts. Any business that maintains its accounting books via the loose-leaf books of accounts system is required to submit BIR approved accounting books and records for the year ending 31 December 2019.

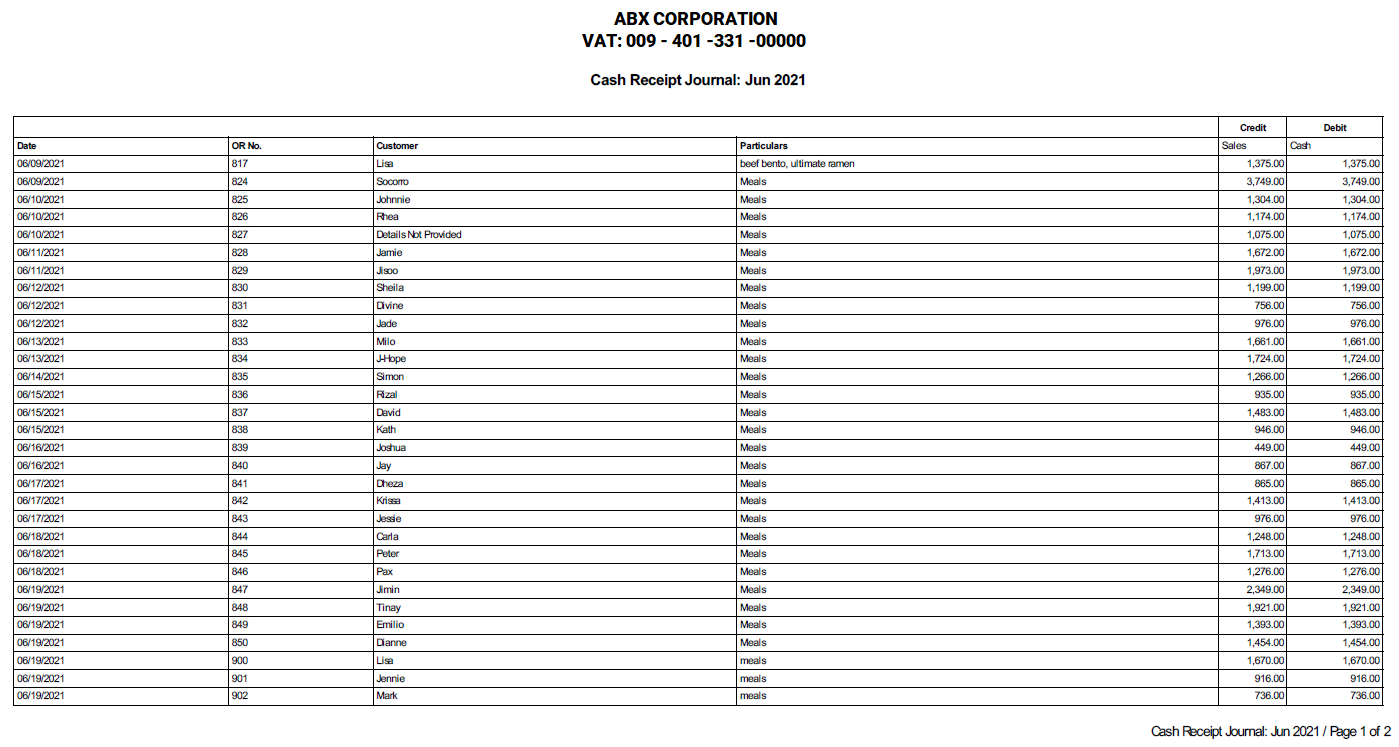

Loose leaf Books of Accountsinvoicesreceipts and other accounting records shall be permanently bound and presented for registration together with a sworn statement attesting to the correctness of the entries made and the number of all invoices receipts Books of Accounts used for the period covered to the RDOLTADELTRD LTD-CebuLTD-Davao where the Head. 7-15 a compromise penalty not exceeding PHP50000 will be imposed in case of failure to keep books of account or records depending on the level of gross sales earnings or. In simple terms these are a computer-aided form of manual recording.

Loose leaf Books for Calendar Year January 1 2021 to December 31 2021 are due for submission on or before January 15 2022. Commitment to permanently bind the loose-leaf forms within fifteen 15 days after the end of each taxable year or upon termination of its use. Loose leaf books of accountsinvoicesreceipts and other accounting records shall be permanently bound and presented for registration together with a sworn statement attesting to the correctness of the entries made and the number of all invoices receipts books of accounts used for the period covered to the RDOLTADELTRD LTD-CebuLTD-Davao where the Head.

68-2017 August 10 2017 This Tax Alert is issued to inform all concerned on the new venue for filing the application for Permit to Use PTU loose-leaf book of accountsinvoicesreceipts and other accounting records. Submission of Computerized Books of Accounts. Municipal Permit and Licenses including other licenses.

Switching to loose-leaf books of accounts. If the deadline falls on a weekend or holiday the deadline will be moved to the next working day. It is important to note that if you use loose leaf books of accounts you are required to print and bind your books for the year then surrender a copy to your RDO deadline of which is every 15th of the following month after year end close.

Any business that maintains its accounting books via the loose-leaf books of accounts system is required to submit BIR approved accounting books and records for the year ending 31 December 2020. The BIR normally provides a 30-day extension period upon request but this may vary per branch. Loose-leaf books of accounts and Computerized books of accounts.

Follow this guide so you can say goodbye to manual handwriting and hello to keeping your accounting records electronically. REGISTRATION OF MANUAL LOOSE-LEAF BOOKS OF ACCOUNTS. Loose-leaf Books of Accounts.

The loose-leaf books of accounts is a recording of transactions through encoding of details in the computer and generating copies by printing this out using the approved loose-leaf format to be bound as the bookkeeping record of the taxpayer. Revenue Memorandum Circular No. Annual Renewal of Registrations.

More ease on the loose. Hello Select your address Books. An affidavit attesting the completeness accuracy and correctness of entries in Books of Accounts and the number of Loose Leaf used for the period.

You will need to print bind and submit your books of accounts that are generated from your spreadsheets or software to your respective BIR Revenue District Office RDO by January 15 of every year. Registration of permanently bound computer-generatedloose leaf books of accounts and other accounting records January 15 or 15 days after the end of the fiscal year no form. Deadline of submission is on or before January 15 of the next calendar year.

Application Requirements Deadline and Renewal.

Updated Guidelines On Ptu Loose Leaf Filing Grant Thornton

Loose Leaf Books Of Accounts Annual Submission

Loose Leaf Books Of Accounts Annual Submission

Loose Leaf Books Of Accounts Annual Submission

Loose Leaf Books Of Accounts Annual Submission

An Ultimate Guide To Loose Leaf Books Of Accounts Application Requirements Deadline And Renewal Filipiknow

An Ultimate Guide To Loose Leaf Books Of Accounts Application Requirements Deadline And Renewal Filipiknow

Formats Of Books Of Accounts Explained

Retention Of Books Of Accounts Five Years Or Ten Years Djka Business And Accounting Services In The Philippines

Loose Leaf Books Of Accounts Annual Submission

How To Apply For Bir Loose Leaf Qne Software Philippines Inc

Loose Leaf Books Of Accounts 2022 Filing

An Ultimate Guide To Loose Leaf Books Of Accounts Application Requirements Deadline And Renewal Filipiknow

How To Register Fill Up And Keep Bir Books Of Accounts An Ultimate Guide Filipiknow

An Ultimate Guide To Loose Leaf Books Of Accounts Application Requirements Deadline And Renewal Filipiknow

What You Need To Know About Books Of Accounts Beyond D Numbers Consulting Co

Loose Leaf Books Of Accounts Annual Submission

Loose Leaf Books Of Accounts Annual Submission

An Ultimate Guide To Loose Leaf Books Of Accounts Application Requirements Deadline And Renewal Filipiknow